How to Charge for Veterinary Services

Veterinarians utilise basic business skills on a daily basis to ensure business sustainability, good client relationships and, ultimately, to improve animal health outcomes.

At the client interface, business skills are required to generate pricing estimates for clinical services, and for invoicing of fees for services and items supplied. This topic provides a summary of fee categories, terminology, tax invoices and estimate creation for professional veterinary services.

Watch our short films

How much will it cost?

Charges and estimates for the client.

From a young vet

Missed charges - the danger of discounting.

Communicating the components in a routine de-sexing to the client

Download a pdf of the learning guide shown below.

-

Introduction

Veterinary fees cover the provision of:

- professional knowledge and/or skill based services, and

- items, such as drugs, pathology and externally provided services.

Thus, services and items are the two broad categories of veterinary fees and each can be divided into sub-categories, as discussed below.

Services are things that a veterinary business does for a client. Examples of professional service fees include:

- Consultation

- Anaesthesia

- Surgery

- Support staff services

- Hospitalisation and case review

- Sample collection fees

- Sample processing fees

- Diagnostic imaging e.g. radiology and ultrasound

- Travel fees covering veterinarian travel to the animal(s) location

- Dispensing and injection fees

Items are things that a veterinary business sells to a client and these are generally "marked'up" items. Examples of veterinary items include:

- Injectable medicines administered or dispensed

- Non-injectable medicines administered or dispensed

- Non-prescription items used during treatment, or to take home e.g. bandages, dog food, dog toys

- Visiting specialist services

- Externally sourced services such as external pathology

Veterinary businesses usually use computer based invoicing programs to create an invoice for a client. These programs enable charging of the client via selection of the professional fees and veterinary items from a master menu or list (a computerised ‘fee schedule'). When a professional fee or veterinary item is selected, the program shows the user the price of the service or item to the client. For compliance reasons, veterinary invoicing programs are set up under an individual animal's or a group of animals' (e.g. flock or herd) name.

Many veterinary procedures are a combination of professional services and veterinary items. All of the components for veterinary procedures are not necessarily made visible to the client on the invoice. Some combined veterinary procedures are termed bundled procedures. An example of a bundled procedure is a de-sexing or a vaccination. The client is informed of a single fee for the procedure, and there is a single entry for the procedure on the invoice, but the computer allocates charges for professional services and items. When the veterinarian charges the procedure, associated items, such as drugs and disposables, are automatically included in the invoice total and deducted from stock levels. Any services or items additional to the standard procedure need to be added to the invoice manually.

Professional and support staff fees

Professional fees are charged for human input into a case, such as veterinary input or support staff input (e.g. clip and clean of a wound by a nurse, puppy classes, sample collection, intravenous catheterisation).

Fees for time spent on a case by veterinary and support staff reflect fixed costs of running the business and include general expenses, support staff, veterinarian salaries and a margin. The margin is required for development, contingency, increased wages to team members, and a return on assets to the owners. Thus, the margin is the component of the professional service fee that can drive improved animal health outcomes through purchase of updated equipment and increase of staff skills through training.

Diagnostic imaging (radiology and ultrasound) fees

Diagnostic imaging offered in routine veterinary practice usually includes radiology or ultrasonography. Other modalities not technically considered diagnostic imaging can be included in this category, such as electrocardiography. Some university clinics and large or more specialised practices may have a computerised tomography (CT) scan facility. Fees for these services are generally categorised as professional fees as they rely on trained staff to conduct the imaging. Some practices apply a further loading for specialised equipment usage. The rationale behind this can be further explored in Ackerman (2007) activity based costing (pp 154 - 155) and profit centre analysis (p 330 - 333).

Pathology fees

Pathology services are performed either internally (in-house) by the veterinary practice or externally by pathology laboratory providers. Whether the pathology is performed in-house or externally, charges to the client are a combination of professional fees, as trained veterinary or support staff perform sample collection, and a marked up item fee on the cost of pathology. Examples of pathology that may be processed in-house include sets of test slides such as a standard six test pre-anaesthetic blood screen. Examples of pathology that may be sent to an external laboratory include a complete blood count (CBC) or a 20 test wellness profile.

In summary, there are two components to pathology charges:- Collection and/or packaging fees (professional fee)

- Item price (as a marked-up item - see Pricing Animal Health Items)

Note: For pathology samples to be sent to laboratories where free transport is not provided, a practice may add a freight fee.

Visiting specialists

In some cases, a practice may book a visiting specialist for a patient. Examples of visiting specialists include ultrasonographers, behaviouralists and surgeons. The specialist will charge a fee to the practice for their professional time, and may also charge for the use of their own equipment. The host practice will charge the client, and add a mark-up to the visiting specialist's fee. That is, the host practice treats the externally provided specialist service as an item to be marked up, as the specialist will bill the practice and the practice must carry that cost until they are paid by the client. The practice also provides the facilities, organises the booking, and bears the cost of handling the client and patient.

Drug fees

There are two components to drug fees:

- Injection/dispensing fee

- Drug price

Injection and dispensing fees

Injection and dispensing fees are professional service fees as they require the input of a veterinarian to request, administer or supervise the administration or packaging of the drugs.

An injection fee is added to the cost of treatment when drugs are injected into an animal. A dispensing fee is added to the cost of treatment when drugs are sold to a client for administration to their animal. When multiples of the same item are sold to a client at one time, a single dispensing fee is applied. Please see the examples below for illustration of this point.

Drug price

The price of the drug to the client is charged per ml, per bottle, or per item (e.g. antibiotic tablet). Drugs are purchased at a cost to the practice, and are then subject to mark-up to determine the final cost charged to the client. Refer to the Pricing Animal Health Items learning guide for more information about mark-up.

Combination of injection/dispensing fee and drug price

Veterinary invoicing programs allow the user to search for a drug. Once found, the program displays the injection fee and unit price to the client. The number of units usually defaults to 1.0. Adjust the units of the drug as required.

Failure to do this will result in errors such as:

- Misquoting or mischarging, most often undercharging

- Incorrect patient record keeping

- Incorrect stock levels recorded in automatic ordering systems

- Incorrect stock levels identified at stocktake

Hospitalisation fees

Hospitalisation fees cover care of the animal by the veterinary nurse while the animal is in hospital. This may be for half a day, daytime only, 24 hours, or multiples thereof. Some veterinary practices' include veterinary review of the patient case in hospitalisation fees. When veterinary review is not included in the hospitalisation fee this cost must be charged in addition to the hospitalisation fee. Therefore, it is important to know what is covered by your practice's hospitalisation fee.

Most practices also have different levels of hospitalisation (e.g. standard, intensive, isolation) to reflect the level of input required for the patient. Practices also have different fees for different species due to the level of infrastructure required (e.g. horse or dog), and some practices have different fees for different sizes of the same species (e.g. large dog or small dog).

Travel fees

Travel fees are for a veterinarian to travel to and from the client or animal's location. Travel fees must, like all other services offered, cover the overheads of the practice, not just the veterinarian's time.

Disposables and theatre fees

Disposables and theatre fees should be charged for procedures that incur these costs, for example swabs, cotton wool, disinfectant, and catheters. These are variable costs which are difficult to charge per item. Different practices have different policies for charging for miscellaneous disposables. There may be different levels of fees, e.g. major or minor, depending on the level of the associated procedure. Theatre fees and disposables may also be bundled together.

Goods and Services Tax (GST)

In Australia, by law, all fees and estimates shown to the client must include the Goods and Services Tax (GST). When the invoice is finalised it must show the amount of GST in the sub-total. It is also wise to show GST amounts for each item on the tax invoice. Currently, GST applies to all items and services sold by veterinarians. Calculation of the 10% GST that the practice is required to collect for the Australian Taxation Office (ATO) is 1/11th of the total invoice balance.

-

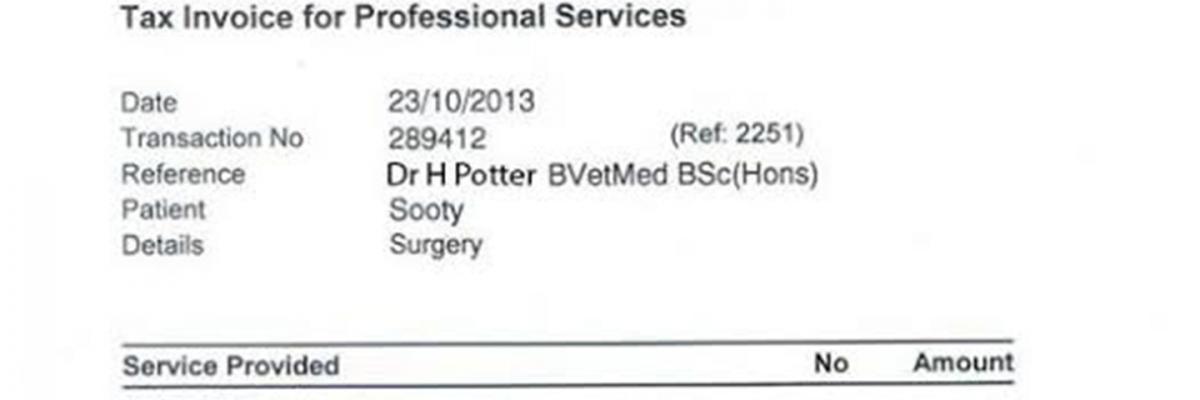

Example of a tax invoice

An example of a tax invoice for a small animal surgery complex case involving anaesthesia, dentistry, medications associated with the dentistry tailored to the needs of the case, and fees for additional preventative health care.

-

Single, bundled or complex veterinary fees

Veterinary work ranges from single fee work to more complex work that requires estimation and itemisation so clients understand what they are paying for and what veterinary treatment has been administered to their animal(s).

Single fees or bundled single fees

For single fee work, determining the price is as simple as referring to the practice’s prepared price list. The front desk staff are usually responsible for conveying this fee estimate to the client. Single fee work falls into two categories, single fees and bundled single fees.

Example 1. Single fee work (no inclusion of extra items)

Examples of single fee work Consultation Revisit Anal gland expression DNA and ID for a horse (horse brought to the practice facilities) Single fee work includes only professional fees and does not include drugs, materials or related items. For single fees, such as those listed above, the receptionist should explain to the client that any medicines and materials required during the consultation will be extra. The veterinarian, as part of their explanation and planning process within the consultation, should tactfully check with the client that they are prepared to pay for medicines prior to administration to the animal.

Bundled fees are for procedures with pricing set at a standard cost for a standard patient, and include both professional time and standard materials, drugs or other items. The detail for the materials is generally not seen by the client on the estimate or the tax invoice. The invoicing program does however allocate the components of the fee in the background to various activity reporting centres (e.g. anaesthesia, surgery, medications) in the practice’s database. Bundled fees vary between practices, but commonly include routine vaccinations and de-sexing.

Example 2. Bundled fees

Example of bundled fees: Dog castration, <10 kg, both testicles palpable Components Detail Cost Pre-anaesthetic exam Pre-anaesthetic exam $50 Hospitalisation Cage cleaning and preparation, pre and post operation observations and nursing $40 Pre-medication including analgesia, anaesthetic, intravenous induction and Isoflurane maintenance Acepromazine <0.5 mls

Methadone <0.5 mls

Thiopentone <2 mls

Isoflurane gas anaesthetic 20 mins$164 Surgery time 15 mins, from start scrub to unglove $50 Theatre fee - minor Surgery pack sterilisation, swabs, suture, sterile gloves, other disposables $30 Pain relief Injectable non-steroidal anti-inflammatories $24 Discharge by nurse $20 Suture removal visit 10 - 14 days later $20 Total bundled price i.e. total price presented to the client $399 Complex veterinary work

Many animals have complicated medical, surgical or management needs, and in some cases need to be hospitalised or cared for on-site for extended periods of time, such as several days or weeks. Complex fee estimates are tailored for a particular patient.

In these cases, it is important that the veterinarian is involved in forecasting the likely course of treatment (see the section on estimates). Effective client communication is important so that the client understands the estimated costs of the veterinary work and has the opportunity to agree to, or decline, additional procedures that will increase the cost.

Examples of complex fees for jobs include:

- Non-routine elective surgeries, or routine surgeries with novel adaptions for the patient

- Diagnosis, treatment and management of medical cases (e.g. pancreatitis, snake bite)

- Diagnosis, treatment and management of surgical cases (e.g. fractures)

- Hospitalised multifaceted surgical or medical cases

Some veterinary practices create invoices per day of hospitalisation, whereas other practices may present a client with an invoice that collates the days an animal is in hospital. At many practices nursing staff assist the veterinarian complete the invoicing process to reduce missed items. Two examples are given below of typical complex fees for not uncommon, but not necessarily standard case scenarios.

Example 1. Complex fee estimate.

Example of a complex fee estimate for an intractable thoroughbred weanling Components Cost Microchip, DNA and ID (standard fee, single horse) $160.00 Drugs (sedation anticipated, dormosedan 0.5 ml) $40.50 Travel (@ $2.10/km travelled) $42.00 Estimate total (including GST) $292.50 Example 2: A male dog for castration, but one testicle is most likely abdominal. Thus, the estimate and final tax invoice need to allow for extra surgery time required to find and remove the abdominal testicle.

Dog Castration <10 kg, only one testicle palpable, other likely abdominal Components Details Cost Bundled fee for standard dog castration <10kg $399 Intravenous fluids Additional intravenous fluids required over standard procedure $50 Exploratory laparotomy Surgery to locate and remove abdominal testicle, 15 minutes @ $7 per minute $105 Disposables Additional disposables required for suture of midline $20 Pain relief Additional pain relief tablets provided to client to administer at home for next 3 days $30 Complex fee total $604 Categories and typical units of fees

When preparing a quote for a complex scenario, you should consider the major categories to ensure you do not miss required items. Broad categories of fees include veterinary specific, support staff specific, diagnostic (laboratory and imaging), hospitalisation, drugs and materials, travel. The units that can be used to calculate pricing for each of these categories are presented below.

Veterinary professional service fees Components Unit of fees Consultation standard, extended, revisit Non-standard procedures per minute or per hour Surgery time per minute or per hour Anaesthetic time First 15 mins, <1 hour, additional half hour Veterinary review in-house per review, often at same rate as a revisit. May be included in hospitalisation fee. Pregnancy test, bovine per head or per hour Pregnancy ultrasound, equine per mare Follicle test ultrasound, equine per mare After hours consultation surcharge before midnight, after midnight After hours consultation per hour Support staff specific fees Components Unit of fees Nail clip per animal Clip and clean dirty wound major or minor flat fee Nurse time per 15 minutes during opening hours and at a higher rate after hours, call back per two hours minimum Intravenous fluid administration Intraoperative fluids per 15 minutes, standard fluids per 24 hours first litre add each bag used Diagnostic (laboratory and imaging) fees Components Unit of fees General health profile per set of tests per animal Off colour profile per set of tests per animal Complete blood count per set of tests per animal Ovine brucellosis complement fixation test (CFT) per test per animal, laboratories may offer a discounted quantity rate Drug fees Components Unit of fees Antibiotics, antiinflammatories, heart medications per ml, tablet, packet or bottle Anaesthetics per ml Intravenous fluids per 100ml, per L or per bag Disposables Components Unit of fees Catheter, IV drip sets per individual item Minor disposables Cover charge for typical swabs, catheters, suture for a minor procedure Major disposables Cover charge for typical swabs, catheters, suture for a major procedure Hospitalisation fees Components Unit of fees Standard per day High level per day Intensive care per day Travel fees Components Unit of fees Distance per kilometre Time per hour or part thereof Zone flag fall + per kilometre

per zone, e.g.a zone fee may apply on particular days of the week to encourage work in a region on a given day

-

Estimates for veterinary services

Service providers are often requested to provide an estimate or quote before work commences. It is a requirement of the Veterinary Surgeons Board of South Australia Professional Code of Conduct to provide an estimate, and this requirement may vary from state to state. Regardless of the requirement to provide an estimate in South Australia, it is always good practice for the following reasons:

- An unexpectedly high account can be financially embarrassing to a client or cause them to dispute the amount

- A client may not want to spend a large sum of money

- If the job is likely to be expensive the client may wish to obtain several quotes

Depending on the type of service, an estimate can be created in one of the following ways:

- Minimum fees for small jobs

- Flat rates for specific jobs based on average cost to perform the work plus an allowance for complications

- Complex estimates that include anticipated services and items, and an allowance for complications

In addition to providing an initial estimate, assure the client that you will obtain their approval before you exceed a specified limit. In the event that the procedure requires less time and resources to complete than estimated, you should charge a lesser amount. This maintains your standard of fairness and integrity, and ensures a satisfied client. Having said that, if you have agreed on a price and you deliver what you have agreed on more efficiently, it is acceptable to only reduce your fee modestly. There are many cases where the veterinarian ends up doing more than originally anticipated, but is unable to pass on the extra costs. Yet, in most circumstances you should keep within your estimate.

Each estimate should be prepared with care. It should be sufficient to cover the time involved to do the job and materials required. Giving low estimates to attract business will damage your reputation if you continually charge the clients more than estimated. Giving low estimates and charging the low estimate to attract business will damage your ability to invest in the practice, staff development, and will decrease your ability to enhance your own and other team members' income. Under-cutting competitors is also unwise since you may not earn enough to maintain your business, and you will find it hard to raise prices at a later stage.

Do not be afraid to set your prices at a sufficient level to support a desirable standard of service and efficiency and also a healthy margin to be reinvested into practice and staff development, and increases in remuneration (see below and also the topic: Fee Setting).

When creating an invoice for veterinary services, ensure you:

- Itemise the invoice as best as possible to allow the client to see relevant services and items

- Endeavour to create an invoice that is similar to the original estimate, unless you have discussed additional charges with the client

Consequences of undercharging and failure to collect payment

High performing service based businesses in Australia achieve an average profit margin of 25% (Boedker et al. 2011). However, the veterinary profession averages around 7 - 12% profitability (depending on the source of information). Therefore, business knowledge is critical to the viability of veterinary practices.

Missed or shaved fees and frequent discounting have a financial consequence for veterinary practices. For example, if a veterinarian forgets to add the cost of a $20 medication to an invoice for a $200 job, 10% has been lost on the job. For a practice operating at 7% profitability, the error has put this job below break-even point.

Without profit many needs cannot be met by the business, including increases in salary to veterinarians and support staff, development of staff and the practice, owner return on money invested, and extra support for veterinarians and staff Thus, for practices to thrive the margin is important. Hence, there is great danger in discounting for any reason whether intended or inadvertent.

-

References and further reading

- Ackermann, L. (2007). Blackwell's Five-Minute Veterinary Practice Management Consult, Blackwell Publishing, Ames.

- Boedker C. , Meagher K., Cogin J., Mouritsen J. and Runnalls J. (2011). Leadership, Culture and Management Practices of High Performing Workplaces in Australia: The High Performing Workplaces Index. University of NSW, Australian School of Business, Kensington.

-

Authors and acknowledgements

Authors

- Dr Adele Feakes, Lecturer, School of Animal and Veterinary Sciences, Roseworthy campus, University of Adelaide.

- Dr Dana Thomsen, Researcher, School of Animal and Veterinary Sciences, Roseworthy campus, University of Adelaide.

Acknowledgements

- Mr Craig Broadbridge, Finance Officer, School of Animal and Veterinary Sciences, Roseworthy campus, University of Adelaide.

- Ms Diane Whatling, Practice Manager, Companion Animal Health Centre, School of Animal and Veterinary Sciences, Roseworthy campus, University of Adelaide.

- Prof Noel Lindsay, Director, Entrepreneurship, Commercialisation & Innovation Centre (ECIC), University of Adelaide.

- Dr Ed Palmer, Senior Lecturer, School of Education, University of Adelaide.